For a long time my family went without a budget. We took things one day at a time and paid a bill whenever it came in. Towards the end of the month things got really tight and we could never figure out where all our money was going. We figured that we should have a lot left to live on after we paid our bills, but we never seemed to have enough. Frustrated and feeling the pinch I decided to draw up a family budget. Here is how I got started:

1. Bills and due dates – The first thing I did was write down all the bills we had to pay every month. I made a note of the average price paid and the date it was due. I also made notes on grace periods and late payment fees as well as online payment fees. By doing this I was able to see what order we should pay the bills in. For example although my house payment was due on the first of the month we had until the sixteenth of the month to actually pay it before a late payment was due. This meant that we could pay some of the smaller bills early in the month and leave that one for later. Instead of being very broke on one paycheck and then having a lot left over on another I was able to balance out the bill payment schedule.

Also by looking at the total amount of the bills I was able to see areas that we could cut down on. Cable television and telephone bills were one of the first places we cut down by switching to a more affordable plan. We also managed to cut down on the price of the home and car insurance by bundling them together. We also cut down on expenses because we noticed that reoccurring charges were coming out of our bank account for services we were not using. It was only a few dollars a month but that really added up. To prevent future occurrences of this I now buy “point” cards that are not connected to my bank for those specific services. When the points run out the service is cut off rather than my bank being charged.

2. Saving and Tithing – Since the Lord is very important in our lives we always include His ten percent first before subtracting anything else from our budget. Then we also subtract ten percent to go into our savings account for emergencies. Before I set up a budget the savings account was the last thing we took out. Now it is among the first and it really shows!

3. Pay times – After getting the bills and things in line I set up a document with the dates and amounts of each pay check. Since my spouse and I are on different pay schedules it is hard to see when we are going to have money without writing it down. I get paid on set dates but my spouse gets paid every other Friday. This means that some months we get income in every week and other months we go two weeks between checks. By writing down the dates we should get paid each month I can easily set up certain bills to be paid by certain checks. I may even split up a large bill, like the house payment, into two checks.

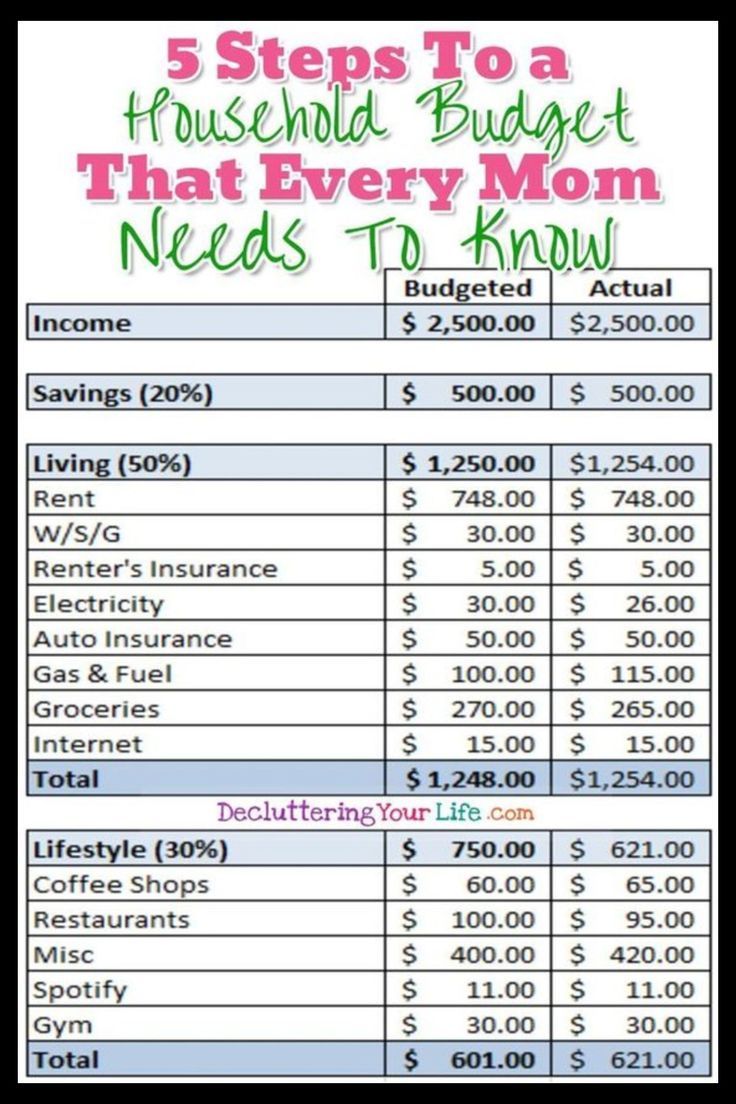

After the deductions are set up I subtract that amount from the check and see what will be left over. That is how much money we have to spend on things like food, gas and entertainment. Depending on what is going on in our lives I will sometimes also calculate the average gas needs for that time period and treat it as a bill too. By seeing exactly how much is left we can choose to forgo eating out so we can go out to the movies or grab something to go instead of making dinner at home.

4. Separate bank account – Since debit cards are a way of life and much safer than cash I don’t feel bad giving each member of my family a card. However they do not get a card to the same account. I have an account set up with my name and the card holder’s name for each member of my family. That way I can look online and transfer money into their account, track their charges, and make sure everything is good to go.

As my children get older and are driving around this has been a big blessing. If they need gas money or other emergency funds I can easily transfer exactly the amount I want them to use into their account. I also have their accounts blocked so that there are no overdrafts or large cash withdrawals allowed in case they lose their card or it is stolen.

I also have separate accounts for bills and for the slush fund. Because I can’t always control when the bills will come out exactly I do not want to accidentally eat into the bill money and then be surprised. By keeping the bill money separate I always have everything ready to go.

5. Money orders – Even in this modern day world there are some businesses and bills that require you pay by check or money order or charge a large fee for online payments. Always go for the money order! At my bank money orders are free if you have an account so it is no problem for me to stop by and get what I need. Yes it is a trip to the bank but it is not far out of my way and, in one case, saves me twelve dollars a month! A trip to the bank and a stamp is far less expensive. Money orders are much better than checks because they come out right away. A check might take weeks or even months to come out of your account and then you are in for a shock.

6. Break it down – This all might seem complex to someone who did not set up the budget. When I explained it to my spouse and kids they looked confused. So I broke it down to make it easier to see. By showing how much money is left from each paycheck for free use my family could grasp how important it was to use that money wisely. If our children needed something, like one needed new shoes and another child needed a battery for her car, then we could set priorities and figure out when in the month was the best time to get those items. Or we could choose to put one of them off until the next month. A vacation, a broken down car, or a doctor’s visit could mean restructuring our plans, but it was no longer overwhelming and confusing. It was easy to see where the money was being spent and what we needed to change.

As you can see setting up a family budget does not have to be complex or time consuming. It is all a matter of lining up your income with what you spend and seeing where the money goes. Once you have a budget set up you will be surprised by how much more money you can save and how frugal you can become without it making a big impact on your style of living.

ABOUT AUTHOR:

Ken Myers is a father, husband, and entrepreneur. He has combined his passion for helping families find in-home care with his experience to build a business. Learn more about him by visiting @KenneyMyers on Twitter.